How I missed out on $14,000 during my undergrad

On June 14th, 2018, I proudly walked across the podium inside the Physical Activities Complex at the University of Waterloo to receive my Computer Engineering degree. I was so gleeful in the fact that I was finally done with this student life shenanigan and didn’t have to think about doing another goddamn trash exam or assignment. I loved to work and I loved getting paid - but being a student made me PAY to work. What a deal.

As with life, wisdom comes with experience and time. Looking back at my student life, there are a bunch of things I regret. The one I talk about here is money I could have easily made.

You see, my parents paid for practically all of my tuition. I mean, I DID pay by myself for 3 semesters when I wanted to feel all financially independent and all, but that’s not the point.

The point is that I didn’t apply for student loans, thinking that my parent’s money will cover it all.

Well, I should have.

There are two parts to this - bursaries and loans.

Bursaries are just free money as long as you graduate. If you decide to drop out of school, then it becomes a loan. There’s no reason to not apply for a bursary. Even if you don’t need any loans, you can still get a bursary just by applying. If you are from Alberta like me, you will get $1500 per semester. I only applied 3 times so I missed out on the other 6. $1500 * 6 = $9,000. Fml.

Loans are interest-free until graduation. Alberta provincial loans are interest free for 6 months AFTER graduation. That’s an insane benefit that I didn’t realize until I had moved out with a full time job.

In Alberta, the process of applying for a bursary is the same as applying for a loan - it’s a 2-in-1 process. If you apply for a loan, you are automatically applying for a bursary as well.

Loan Interest Breakdown

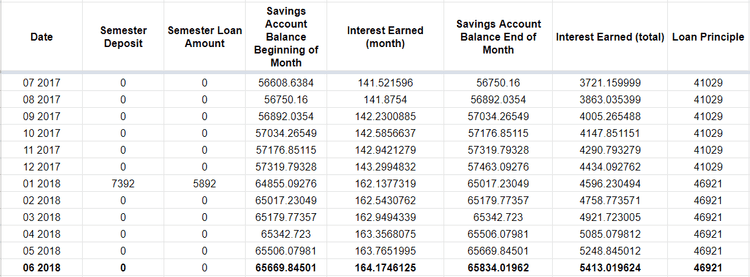

I made a spreadsheet of how much I would have been able to make on interest alone.

Assuming a 3% interest rate, I would have made $5,413.02 by the time I graduated.

Why 3%?

Well, first of all 3% is the typical promotional rate that I see going around right now.

I wouldn’t park the loans in some savings account at a big bank like RBC or BMO. Their interest rates are a meager 0.1%. Terrible place to have your savings.

Instead, I would be bouncing around from bank to bank (usually online banks like Tangerine, Simplii, EQ) on promotional interest rates in secure accounts. Then I would be bargaining with banks to extend promotions.

Second, 3% is very conservative considering the time period of 2012-2018. In fact, promotional interest rates right now (3%) are pretty low compared to back in the day. For example, my partner was able to get a 6% promotional rate on a 2 year GIC in 2016 with RBC.

I’m pretty sure I would have gotten more than 3%, but I’m just being conservative.

Summary

$9,000 from bursaries and $5,413 from loan interest = $14,413

As a student, I was pretty frugal. I was financially sensitive and careful where I spent each $5 bill.

For a person like me, $14,413 is a big friggin deal! That is enough to have covered the tuition, rent, food, utilities, and more for a semester! I feel so silly for missing out on this.

So, pro-tip: apply for bursaries all the time! Get student loans as well even if you don’t need them and put them in a high-interest savings account until you graduate.